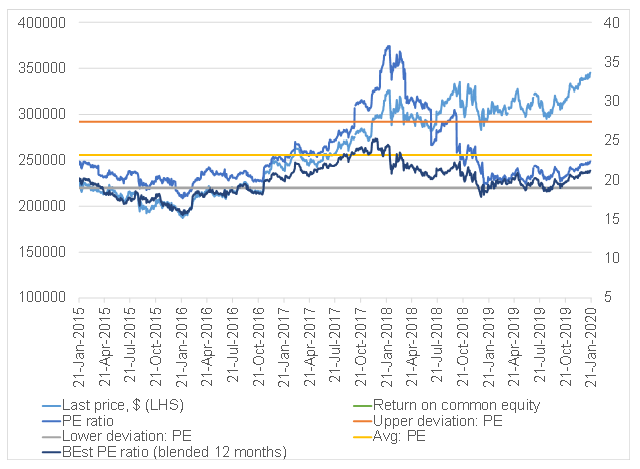

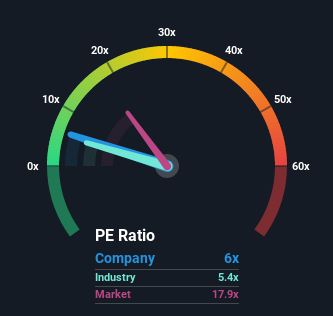

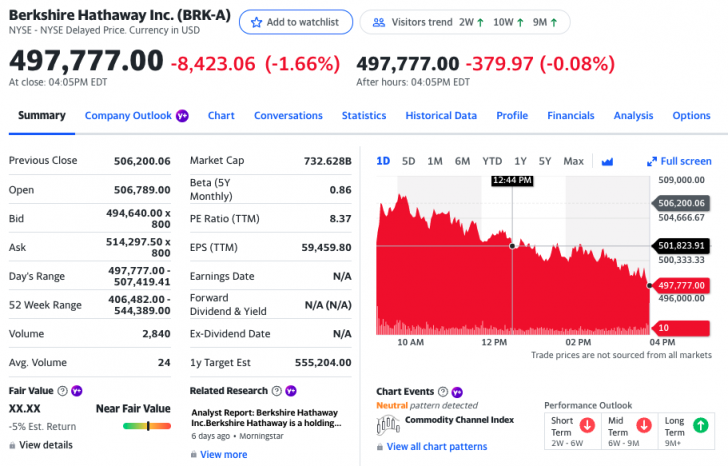

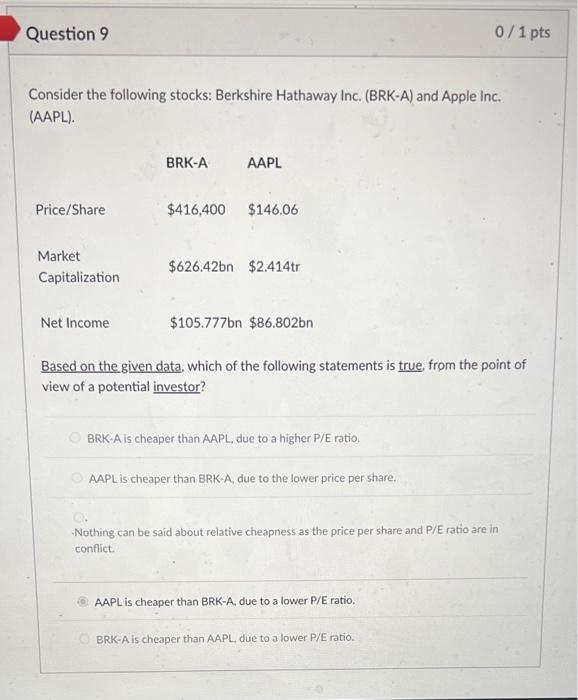

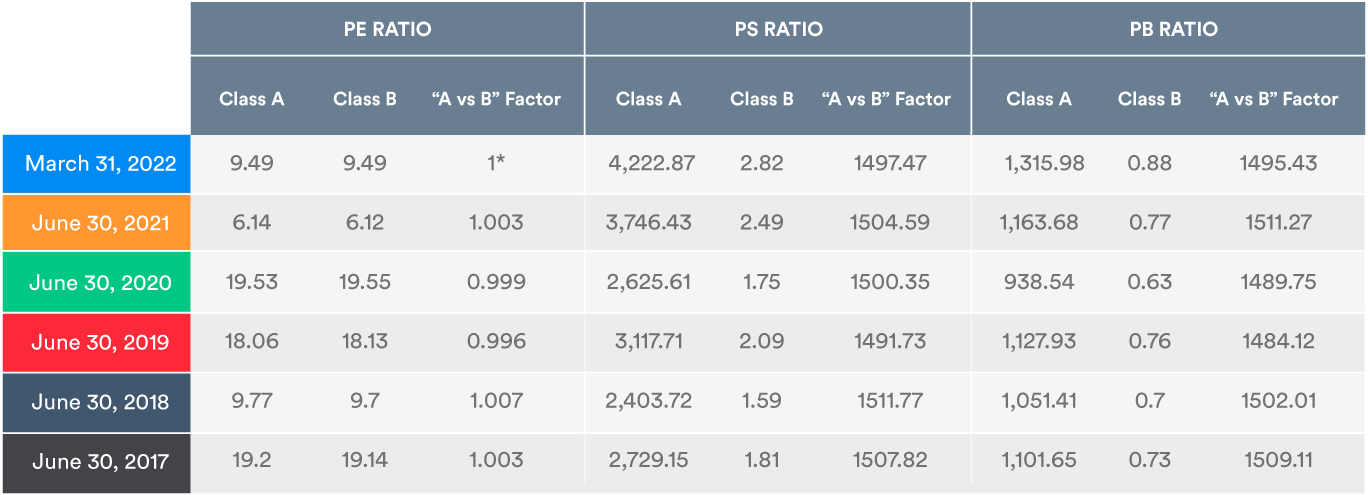

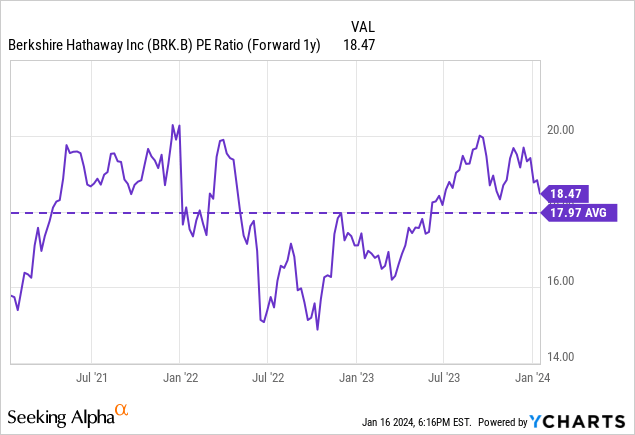

Berkshire Hathaway's (NYSE:BRK.A) Current P/E Reflects an Unusual Year, Investors May be Overenthusiastic

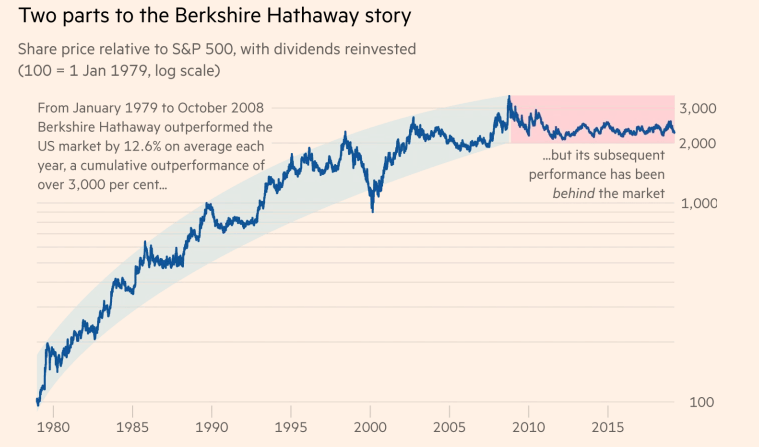

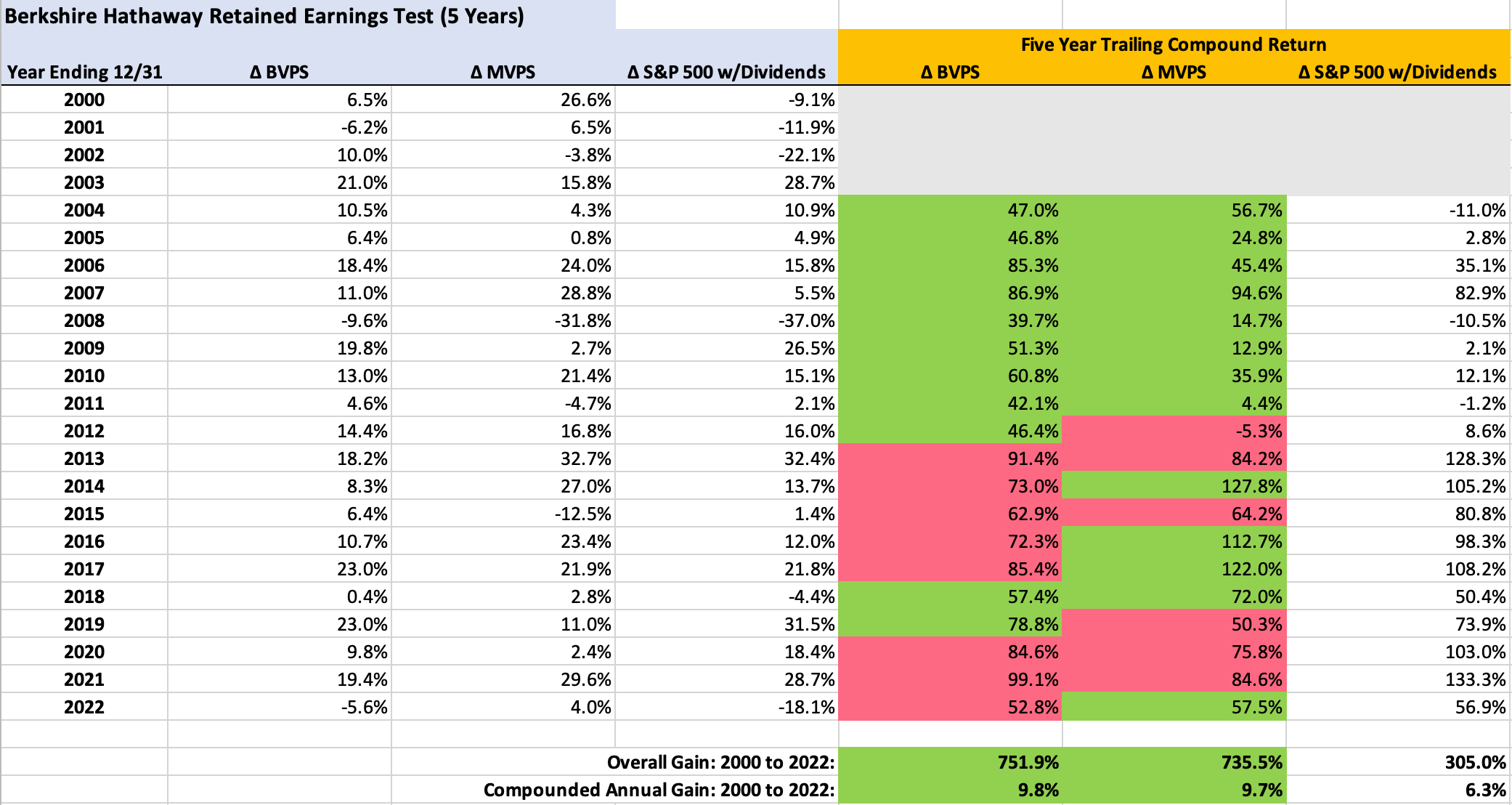

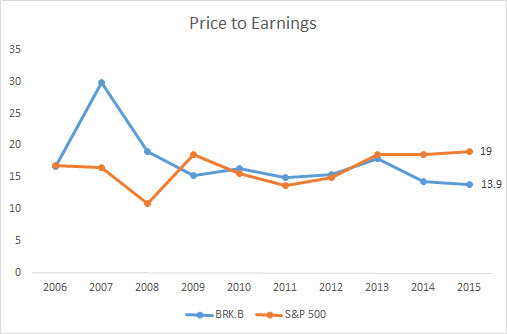

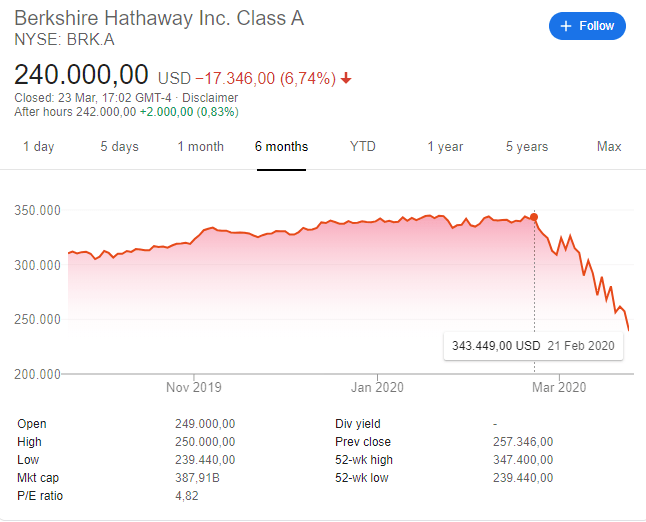

Berkshire did not underperform the S&P 500 despite returning 'only' 9% yearly vs 12% since 2008 - Sven Carlin

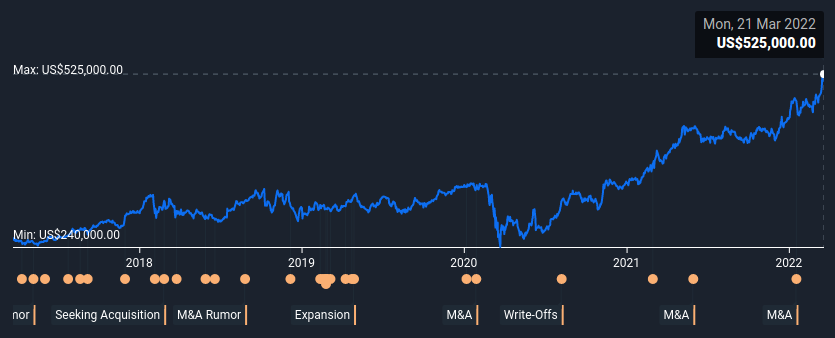

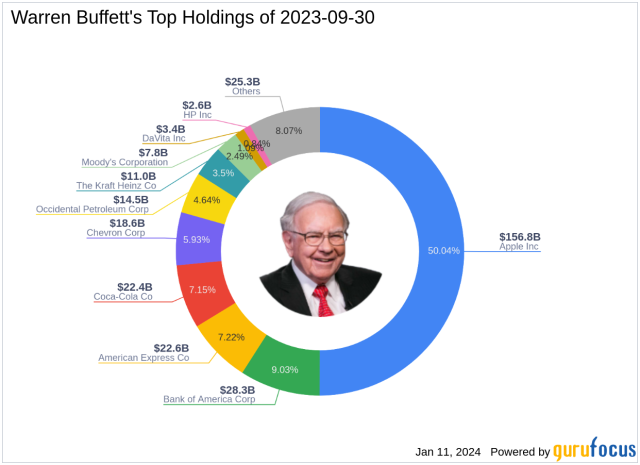

Berkshire Hathaway Stock Price Prediction: BRK.A Share Price Is Just Inches Away To Cross $540000 - The Coin Republic

:max_bytes(150000):strip_icc()/brk_vs_sp_500_one_year_return-f104c804c6e047fdb52f824884a3c55b.png)